Table of Contents

his guide provides step-by-step instructions on how to set tax rates for your DX1 online store. DX1 recommends you consult with an accounting professional when determining how these settings will be configured for your particular situation.

Note on Options:

- By State: With this option you must manually set a tax rate for each state in which you wish to collect tax. The Customer's billing address will be used as the basis for state.

- Automatic: This option is only available for DX1 DMS users. With this option, taxes will be collected using the tax configuration in place for the DMS, just as though the invoice were manually created in the dealership.

Guided Tour

Step by Step

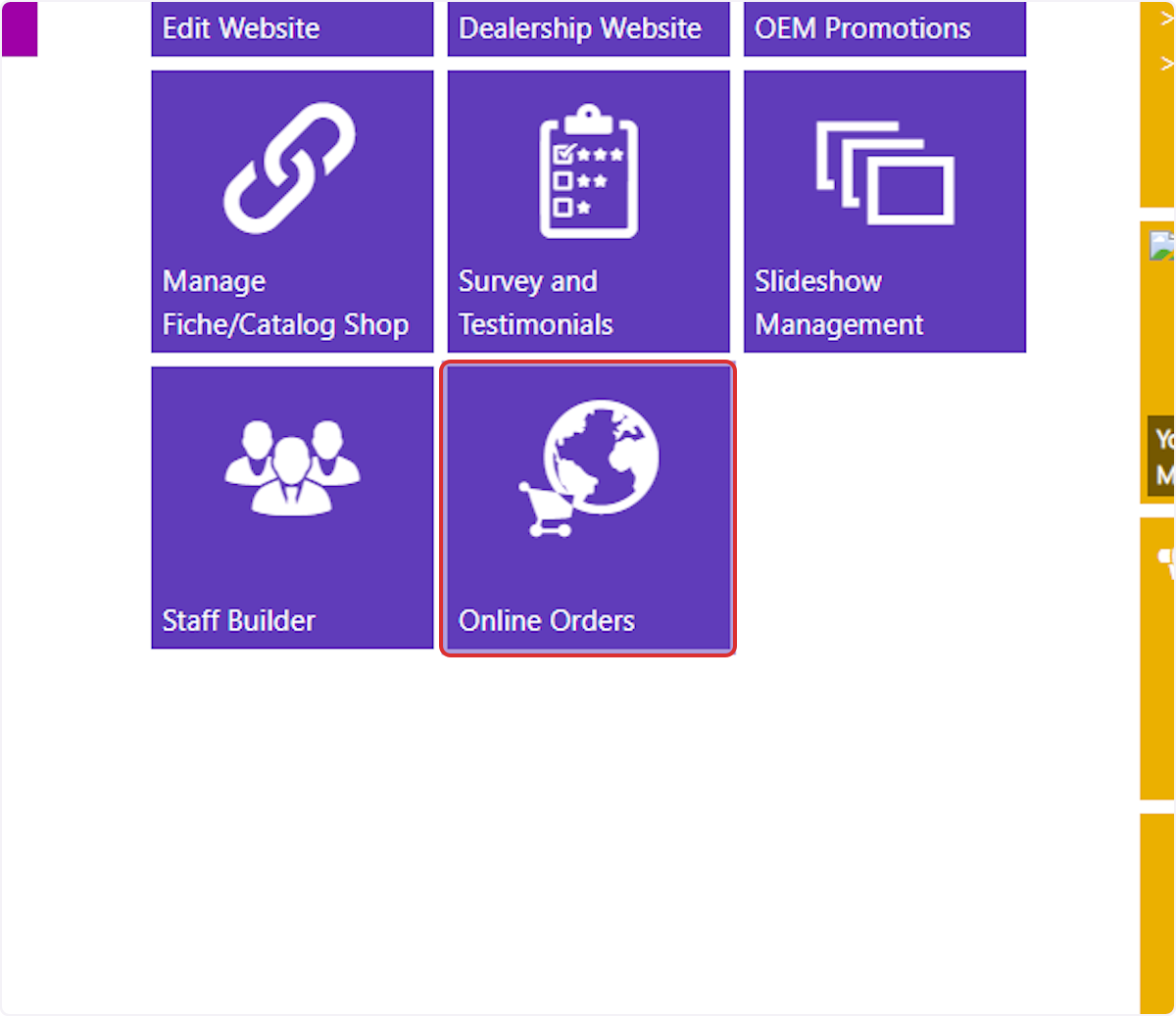

1. Select the 'Online Orders' tile from the Dashboard

NOTE: If your Dealership is using DX1 DMS, this tile appears under 'Parts and Accessories'

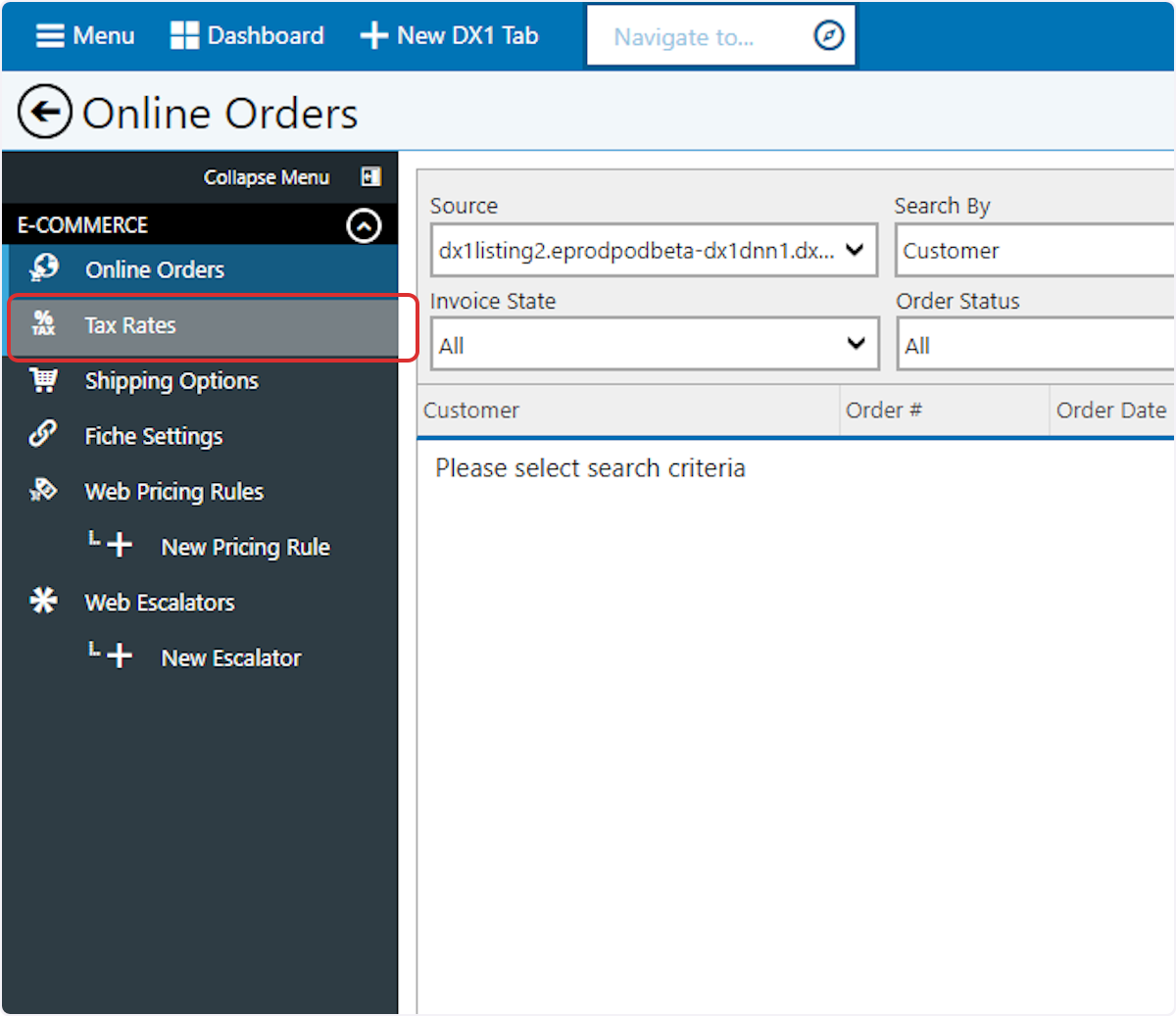

2. Select Tax Rates in the left hand menu.

3. To manually set tax rates by state, continue to Step 4. To set tax collection to Automatic (and use DX1 DMS tax set up), continue to step 11

4. Select By State in the Tax Collection Method dropdown

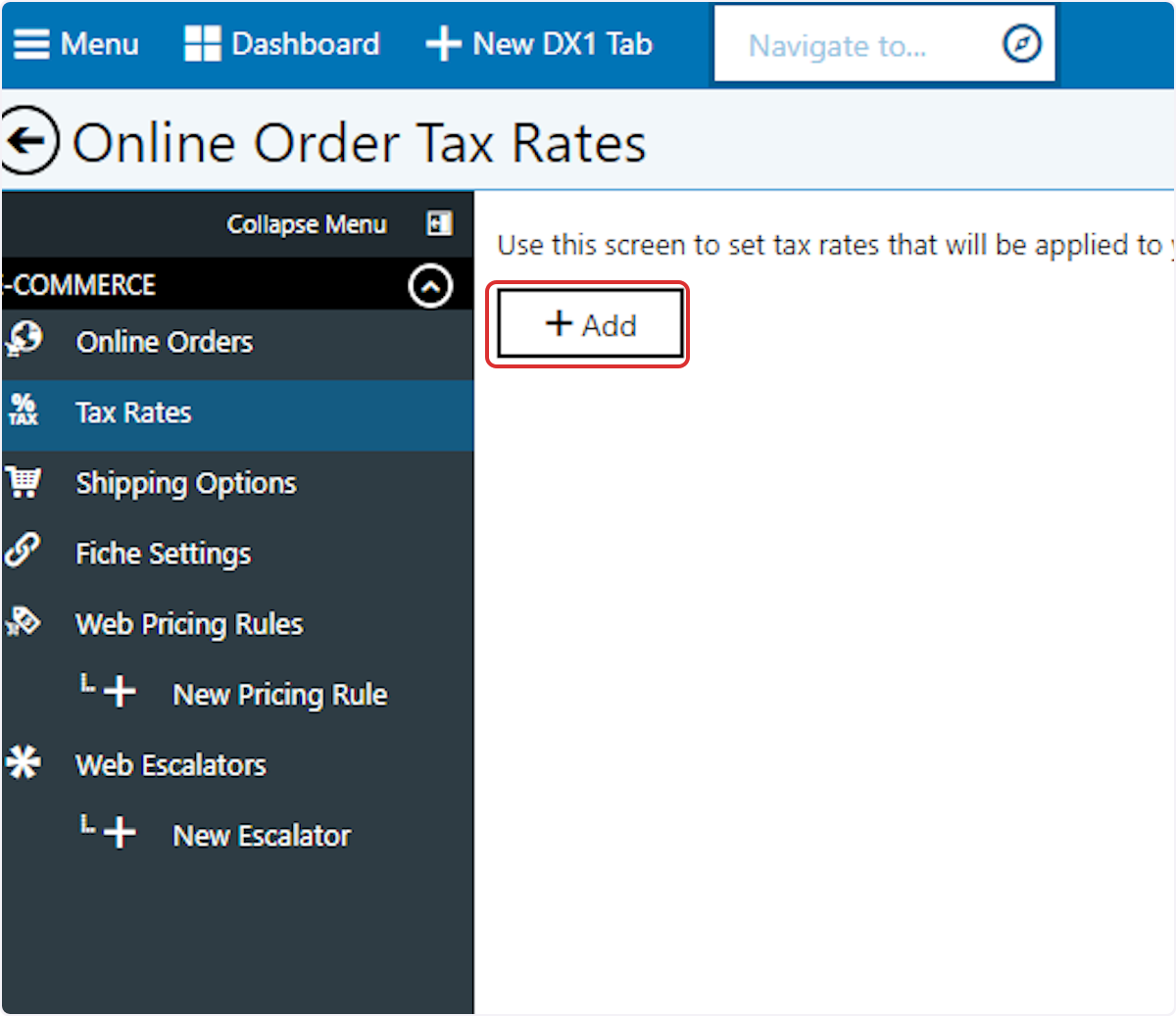

5. Click +Add

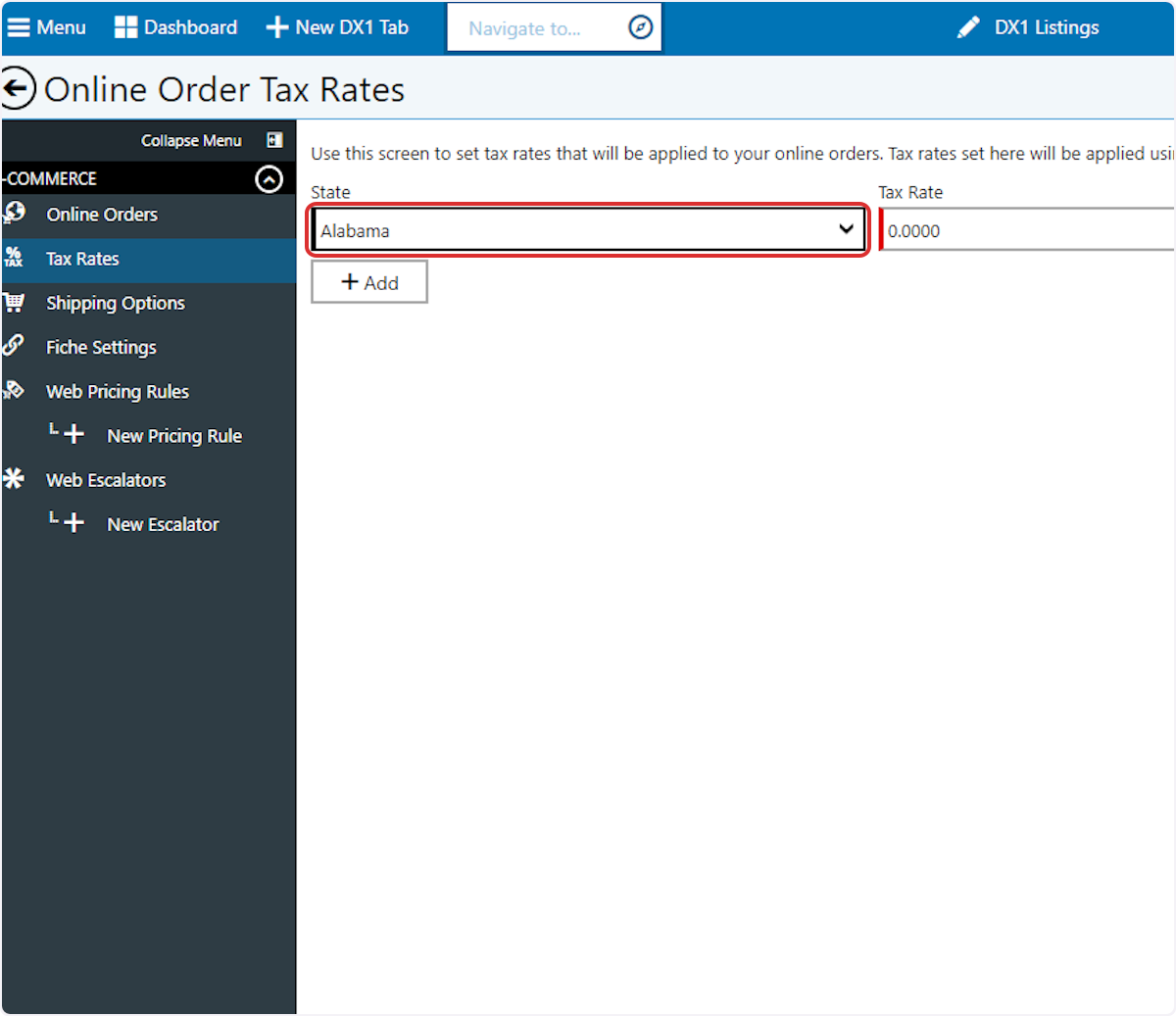

6. Select a state

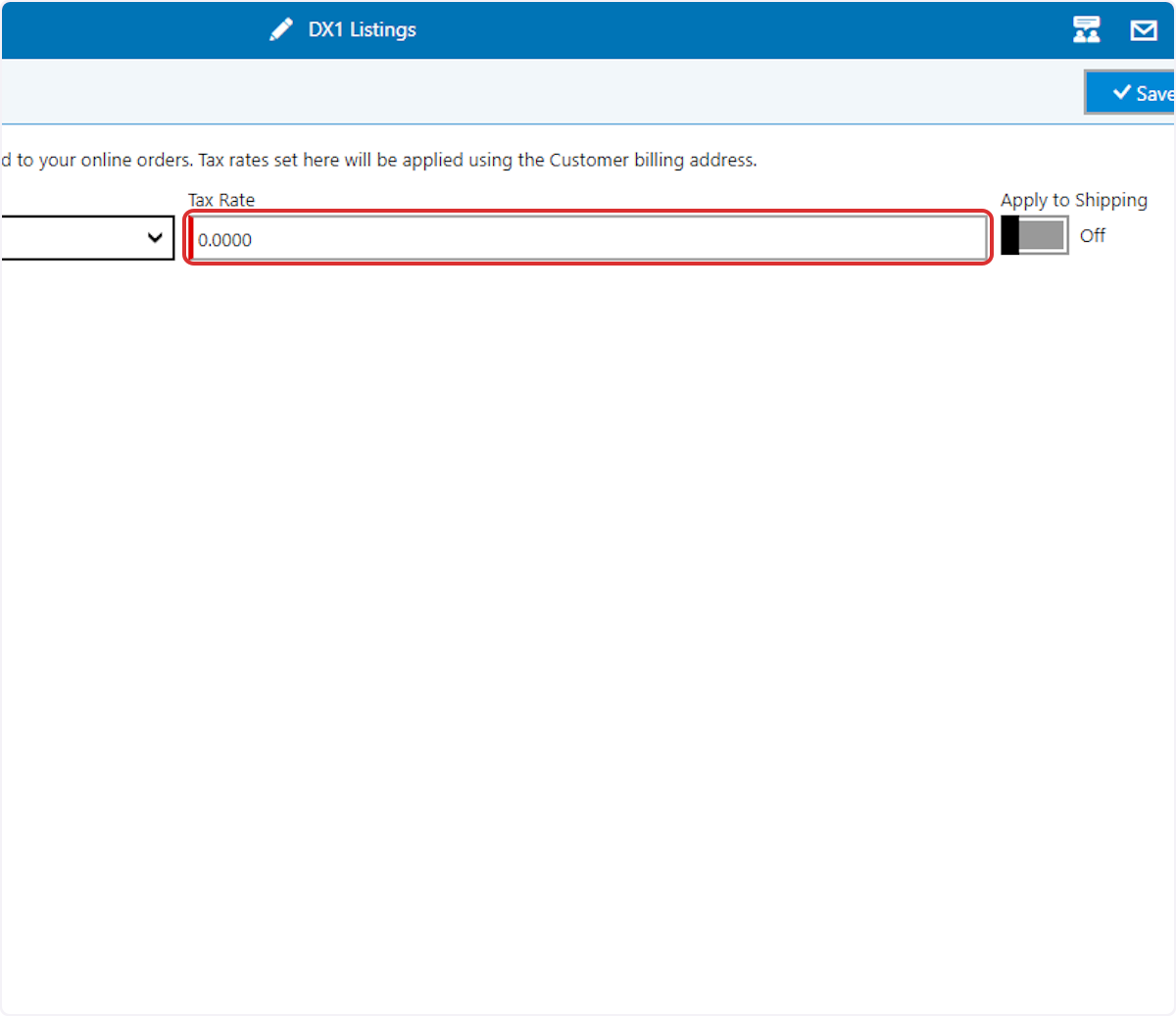

7. Enter your desired tax rate, eg for 7% tax rate, enter 7.0000

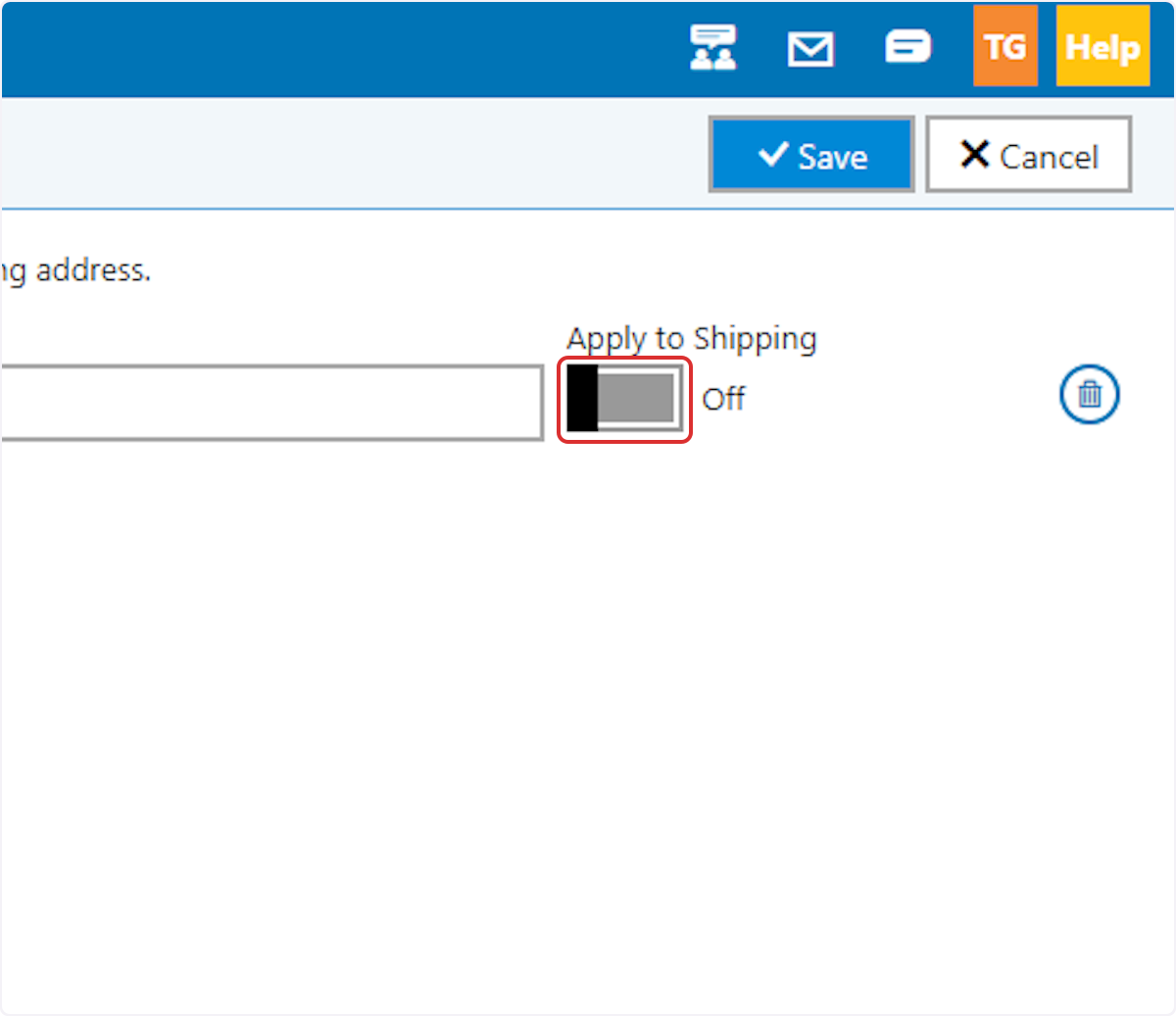

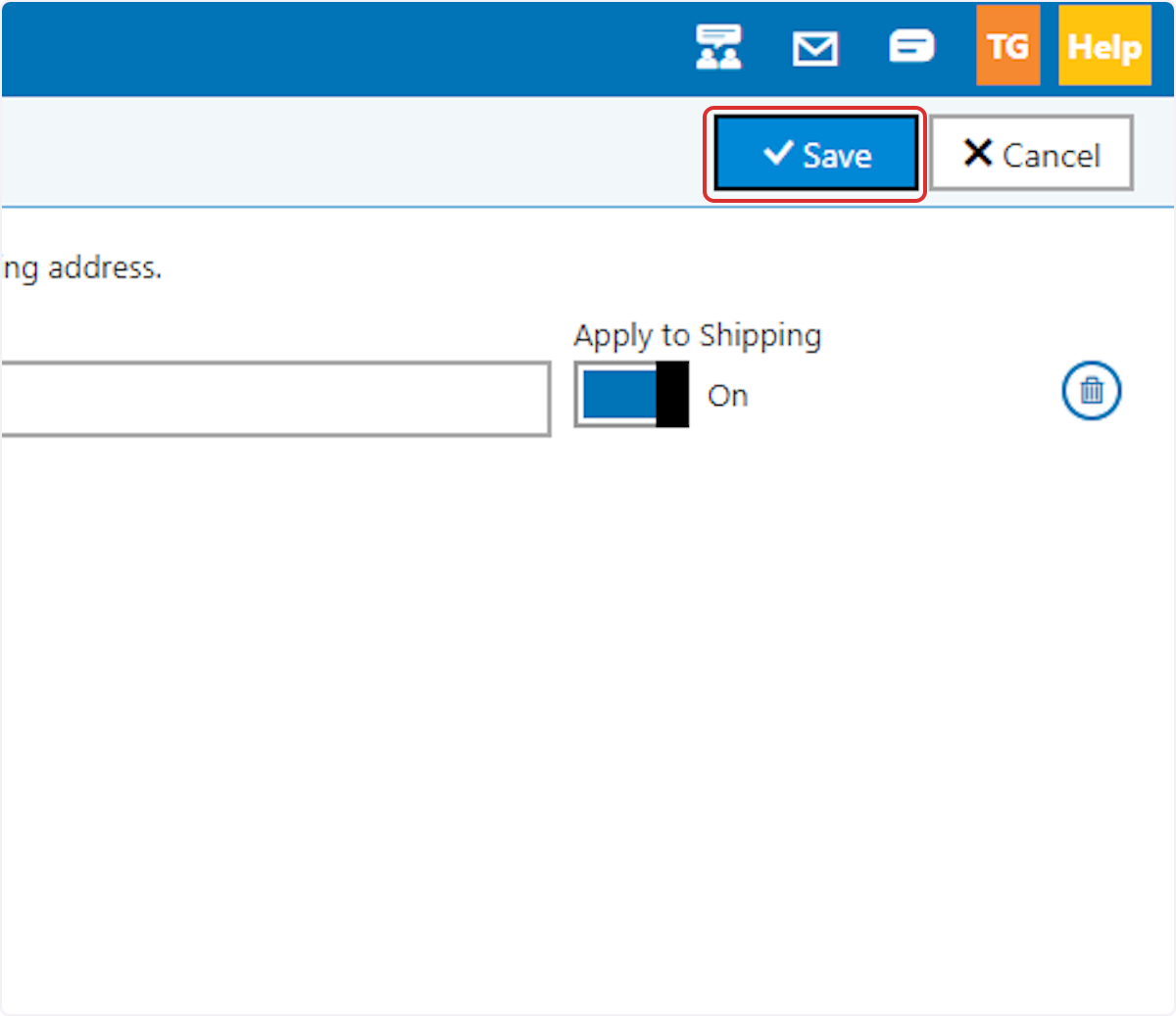

8. If you wish to apply the tax to shipping charges as well as merchandise, toggle the 'Apply to Shipping' toggle to the ON position.

9. Click on 'Save'

10. Repeat for each additional state in which you wish to charge tax.

11. To use Automatic tax rate collection using the DX1 DMs tax rate settings, select 'Automatic' in the 'Tax Collection Method' dropdown.